Are mortgage rates about to go up?

There’s been a glut of news articles recently suggesting interest rates (including mortgage rates) are going to go up. In this post we look at what’s causing these headlines and whether it might be worth taking action.

What’s been said?

In a rare example of candour regarding potential future actions, Andrew Bailey, governor of the Bank of England, recently said it “will have to act” to combat rising prices, aka inflation, which is forecast to hit 4% by the end of this year – double the Bank of England’s target of 2%.

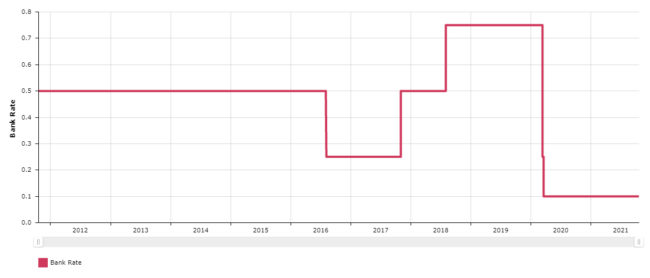

The Base Rate has been at an all-time low of 0.1% since Covid struck in March 2020 and any increase is likely to be small, perhaps back to 0.25% where it spent much of 2016 and 2017.

Why put up interest rates just because inflation is higher?

Historically, putting up interest rates drives inflation down, because it pushes up the cost of borrowing, meaning consumers spend less, demand for goods and services reduces and prices fall due to the lower demand. Inflation puts pressure on wages – effectively devaluing take-home pay because if prices are rising the same salary buys less this year than it did last year. That said, many of the upward pressures on inflation are caused by supply chain issues due to Covid, Brexit and international energy prices, so it’s complicated.

What does this mean for my mortgage?

- If you’re already in a fixed rate any changes in interest rates won’t affect you until the fixed rate ends. If it ends in the next 6 months then it’s worth getting advice because you might be able to reserve a new fixed rate now, to come into effect when your current deal ends.

- If you’re paying a relatively high fixed rate (more than 2.5%) and you’ve got more than 12 months left on your current deal, it might be worth taking advice from an independent mortgage adviser who’ll be able to help you work out your options and whether it’s worth breaking out.

- If you’re currently on a tracker, discounted or variable rate mortgage then it’s worth taking advice ASAP – you may well be free to move to a fixed rate without penalty.

Will the cost of new mortgages go up?

If (or rather when) the Bank of England increases the base rate, it’s impossible to say exactly what the effect will be on the mortgage rates available from lenders, but chances are they’ll increase to some extent. But it’s a complicated picture, because there are a number of factors affecting mortgage rates. Some mortgage lenders rely on the retail deposits they take in from savers to fund their mortgage lending – this typical building society model is quite stable,

whereas other lenders rely more on money they’ve bought on the money markets to lend to us – these lenders are more exposed to ‘swap rates’ which is what banks charge each other to borrow money.

Some lenders have already pulled some of their cheapest products. Whether this is a sign of things to come only time will tell, but at the time of writing there are still plenty of ‘best buy’ fixed rates at less than 1%, mainly for those with a deposit/equity of at least 25%.

If this has got you thinking, get in touch and we’ll be help you understand what’s possible, or sign up to our monthly newsletter, to keep your finger on the pulse.

Sam Murphy – 21st October 2021

Sources

https://www.ft.com/content/e79ea7cc-6515-40b7-a8db-ad9114621953

https://www.telegraph.co.uk/business/2021/10/15/bank-england-steps-closer-rate-hike/