Help to Buy is changing – what you need to know…

With the new Help to Buy scheme due to commence in April 2021 and the recent government announcement of an extension to the current Help to Buy scheme, this has led to many having questions regarding current and future applications to the scheme.

To help both brokers and clients through this confusion, Accord Mortgages and Sesame Bankhall Group identified the top 10 questions that we’ve seen and provided answers for each of them.

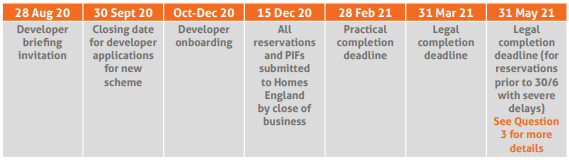

Expected Timeline

Current scheme questions

1. What is the latest date for submitting a Property Information Form (PIF) under the current scheme?

All reservations and PIFs under the current scheme must be submitted to Help to Buy agents by close of business on Tuesday 15 December 2020.

2. Can an existing First Time Buyer reservation whose plot is not going to be built by 28th February switch to the new product easily?

Homes England has been explicitly clear that this will be a brand new scheme and there can be absolutely no switching on plots from one scheme to the other. A property on the new scheme requires a new application form and the new scheme carries different documentation. Homes England has also segregated systems for the two schemes.

3. I reserved a property before 30th June 2020 and have experienced severe delays – do I have any additional time over and above 31st March 2021 legal completion deadline?

Homes England will work with those who had a reservation in place before 30 June to assess their situation and look to provide an extension where necessary. In these cases, they will have until 31 May 2021 to legally complete.

New scheme questions

4. Can brokers help their client complete their Help to Buy application on the new scheme?

No, this must be completed by the customer.

5. My partner owned a property 10 years ago, but I am a first time buyer. Are we eligible for the new scheme?

No. All applicants must be first time buyers. A first time buyer is defined under the scheme as ‘someone who does not own, and has never owned, a home anywhere in the UK or the world.’

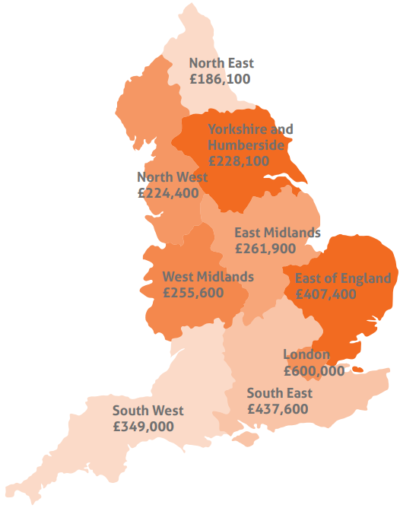

6. What are the new regional price caps?

The full purchase price caps for the new Help to Buy scheme are set at 1.5x the average first-time buyer price in each region, at forecast values for 2021-22 (up to a maximum of £600,000 in London). See the map for the full regional breakdown.

7. If a plot was going to be released for sale at a higher price (for example, in Yorkshire at £230,000 which is £1,900 over the cap), would the builder be allowed to provide a discount so that the Council of Mortgage Lenders, reservation form and contract stated it was under the cap (for example, £228,000)?

The agreed selling price must be recorded on the Property Information Form and all other documents as £228,000. It must not be described as £230,000 discounted by £2,000 to £228,000. The same applies to all the subsequent documents, mortgage, land registry etc. The selling price must also be £228,000.

8. My developer is not in contract yet for the new scheme, what is the timeline for this?

Builder onboarding commenced in September and Homes England is now working with developers directly to get them into contract. Homes England will shortly be publishing the new Buyers’ Guide and Help to Buy Agents are preparing to take new scheme reservations but the first reservations cannot be taken until a builder is fully in contract. Homes England have advised that everyone will be communicated to in good time as to when first reservations are anticipated to commence.

9. Do you have any information on when the new Help to Buy products will be launched by lenders?

There is currently no official launch date. Some lenders are starting to put out products for the new scheme, however, other lenders may continue to accept applications on their current products. This means it is important to check with the lender.

10. Will the new Help To Buy scheme only apply to leasehold properties with a peppercorn ground rent? If so, does this only apply to leasehold houses, or to all leasehold properties?

Yes, the peppercorn ground rent provisions apply to all leasehold properties (including flats) sold in the new Help to Buy 2021-23. Also, the leasehold house exemptions are much reduced in the

new scheme.

We hope that the questions and answers have helped to allay some of your concerns around both the current Help to Buy programme and the one coming in 2021. If you’re thinking of using the scheme or would like to have a chat about anything please don’t hesitate to get in touch.

Thanks to Accord Mortgages and Sesame Bankhall for supplying the information in this article.